You must submit proof of payment with your reimbursement request. The braces must have been placed (or the initial work provided) and must still be on the patient. To be reimbursed for orthodontia, the following criteria must be met: Claims may be made for a lump sum of the entire amount of the participant's liability (up to the annual limit). Previously, participants were required to claim monthly payments.  vision care expenses such as eyeglasses/contacts/LASIK eye surgery and artificial eyeĪ participant who pays in a lump sum may claim the amount at once. transportation expenses related to illness ( see sample mileage claim). substance abuse treatment including smoking cessation. psychotherapy & psychoanalysis counseling. feminine products including menstrual care products. dental expenses and dentures (bonding & sealants). birth control, pregnancy & fertility kits and artificial insemination. Children no longer have to be tax dependents in order for you to be reimbursed for their medical expenses.Įligible expenses include (For more information, see OTC claim instructions and complete list of eligible expenses ) : Your child may be a son, daughter, adopted child, stepchild, or eligible foster child. You may claim eligible medical expenses for your child through the end of the calendar year in which they reach 26.

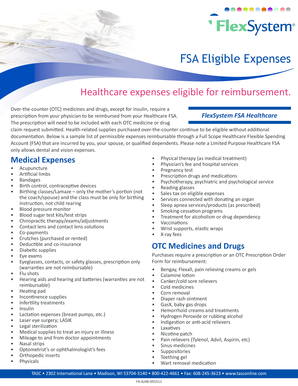

vision care expenses such as eyeglasses/contacts/LASIK eye surgery and artificial eyeĪ participant who pays in a lump sum may claim the amount at once. transportation expenses related to illness ( see sample mileage claim). substance abuse treatment including smoking cessation. psychotherapy & psychoanalysis counseling. feminine products including menstrual care products. dental expenses and dentures (bonding & sealants). birth control, pregnancy & fertility kits and artificial insemination. Children no longer have to be tax dependents in order for you to be reimbursed for their medical expenses.Įligible expenses include (For more information, see OTC claim instructions and complete list of eligible expenses ) : Your child may be a son, daughter, adopted child, stepchild, or eligible foster child. You may claim eligible medical expenses for your child through the end of the calendar year in which they reach 26.

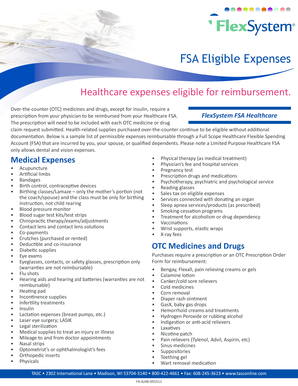

IRS Rules for Coverage of Your Child's Medical Expenses The following categories of items do not require a doctor’s prescription (For more information, see OTC claim instructions and complete list of eligible expenses ): Estimate your tax savings for medical expensesįSA reimburses expenses for over-the-counter (OTC)drugs, medicines, biologicals, equipment, supplies and diagnostic devices. The expenses must be primarily to alleviate or prevent a physical or mental defect or illness.Įxpenses qualify for the medical FSA based on when they are incurred, not when paid. Qualifying health care expenses include amounts incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, and for treatments affecting any part or function of the body. See maximum annual health care expense claim limits. Only the portion of the expenses you owe after insurance payments can be claimed.

Qualifying health care expenses are those that are incurred by the employee, the employee's spouse, or the employee's qualifying child or qualifying relative during the plan year for medical care (as defined in Section 213(d) of the Internal Revenue Code), excluding all insurance premiums and long-term care expenses.

0 kommentar(er)

0 kommentar(er)